|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

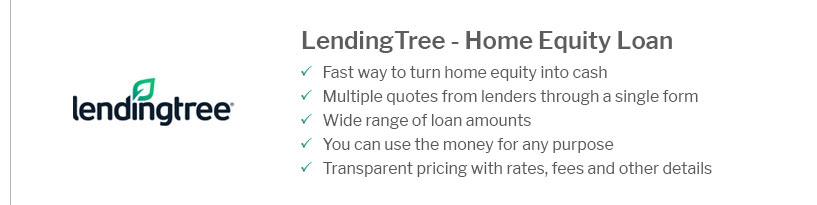

Understanding the Best Home Equity Rates for Your NeedsWhen considering tapping into your home's equity, finding the best home equity rates is crucial to maximizing your financial benefits. In this article, we will explore key features and highlights that will help you make an informed decision. Factors Affecting Home Equity RatesCredit ScoreYour credit score plays a significant role in determining the home equity rate you qualify for. Higher scores typically mean lower rates. Loan-to-Value RatioThe loan-to-value (LTV) ratio is another critical factor. The lower the LTV, the better your rate might be. Market ConditionsEconomic trends and market conditions can impact the interest rates lenders offer. Staying informed can help you lock in a favorable rate. Comparing LendersWhen searching for the best home equity rates, it's essential to compare offers from various lenders. This allows you to choose an option that fits your financial situation.

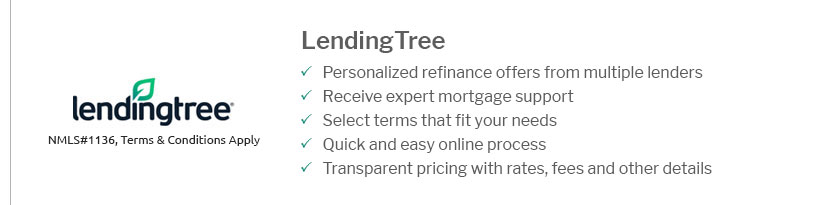

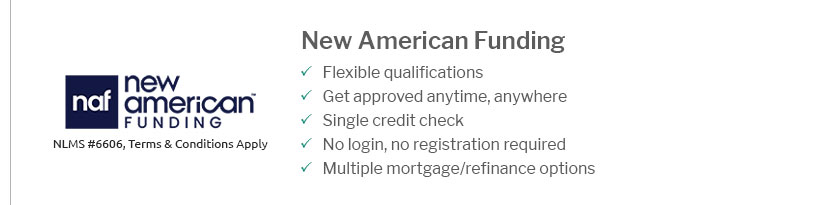

Exploring the best refinance interest rates can also give you insights into the overall lending landscape. How to Secure the Best RatesPrepare Your FinancesEnsure your financial records are organized and up-to-date. This preparation can help in negotiations and improving your eligibility. Shop AroundDon't settle for the first offer. Compare rates from multiple lenders to find the best deal. Negotiate TermsNegotiation can lead to better terms and potentially lower rates. Pros and Cons of Home Equity LoansUnderstanding the benefits and drawbacks of home equity loans can help you decide if this financial product suits your needs.

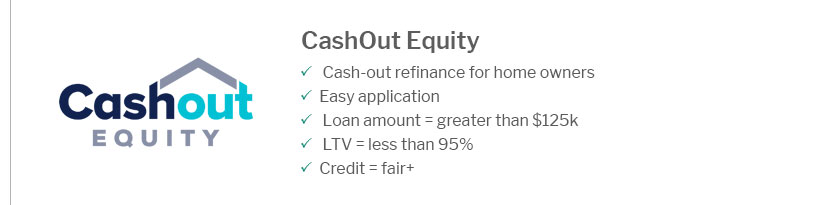

For those considering a second mortgage, you can apply for 2nd mortgage online to streamline the process. FAQWhat is a home equity rate?A home equity rate is the interest rate charged on a loan secured by the equity in your home. It determines how much you will pay back in addition to the principal loan amount. How can I improve my home equity rate?To improve your home equity rate, enhance your credit score, reduce your LTV ratio, and stay informed about market trends to lock in a favorable rate. Are there risks associated with home equity loans?Yes, the main risks include the possibility of foreclosure if you default on payments, as well as the impact of fees and increased debt on your financial stability. https://www.usbank.com/home-loans/home-equity.html

Consolidate debt, get access to cash or lower your mortgage interest rate with a home equity line of credit from U.S. Bank. https://www.liberty-bank.com/personal/loans/home-equity

Home Equity Rates. Jump To: Line Rates | Loan Rates. Home Equity Line Rates. Liberty Bank will help you find the home equity line of credit that fits you best. https://www.cbsnews.com/news/whats-a-good-home-equity-loan-interest-rate-in-2025/

So consider a rate under 8.55% for a 10-year loan or 8.49% for a 15-year one valuable and worth securing today. That said, the best home equity ...

|

|---|